Starting Your Own Business to Pursue Your Dreams

Not everyone may be suited to the self-employed lifestyle, however when you know it is right for you, it is important to ensure you are fully prepared. By choosing to go self-employed, you are starting your own business, no matter how large or small your endeavor may be. Here are the tips you need to successfully leave your job and pursue your dreams.

Write Your Business Plan

When you start your business, it is important to have a clear plan in place. Typically, business plans include:

Executive summary

Company description

Market analysis

Organization and management

Service or product

Marketing and sales

Funding request

Financial projections

Appendix

However, if you are unfamiliar with the business plan template, it will be beneficial to look into Business Planning Software like Business Plan Pro by Palo Alto Software. This type of software includes additional support that you may need to be successful, including tools like industry research, networking, samples plans.

Find the Right Insurance

From the day that you start your business, you want to ensure that you are protected with the right insurance. It will depend on the type of business for which insurance types will be most beneficial. If you are just starting out, consider professional liability insurance policies, which can vary by industry, but overall they are meant to cover you against claims of negligence. If you sell a physical product you will need product liability insurance, property owners will need property insurance, and if you have an employee you need workers' compensation insurance.

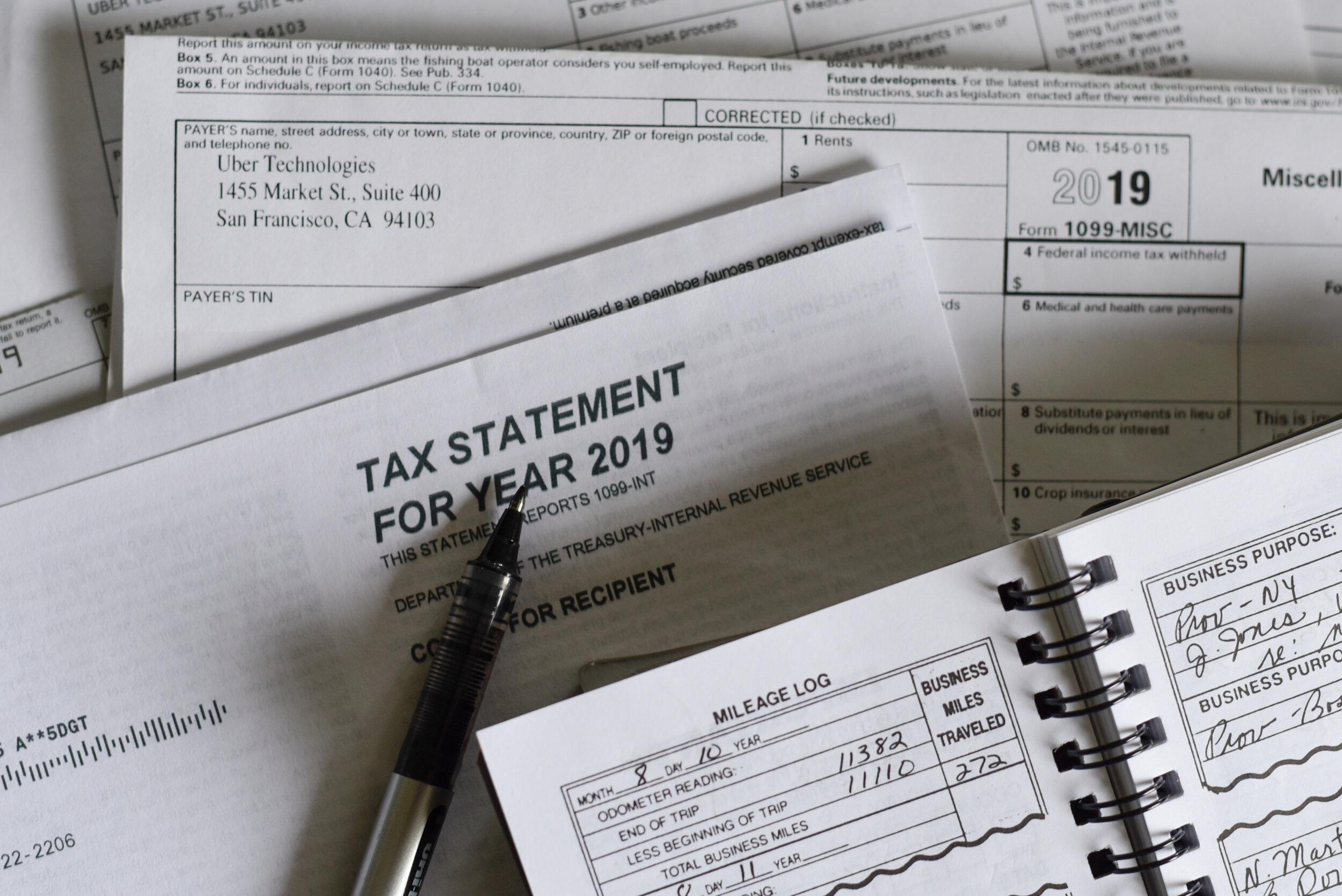

Self-Employment Taxes, Write-offs, and Registering Your Business

Becoming self-employed can make doing your taxes more complicated. One way to make to the process go more smoothly and avoid the trial and errors, you can hire a tax professional who can guide you through the process of filing. If you don't have the budget for a tax professional yet, keep in mind the current federal self-employment tax rates and additional taxes in your state. Some of the tax write-offs you may qualify include: business supplies, office space rent, and professional fees.

When you go to officially register your business, you can choose to register as a sole proprietorship or an LLC, depending on what your tax professional recommends.

Find an Office Space

Setting off into the world of self-employment offers the opportunity to choose where you will work. With the option to work from coffee shops, shared workspaces, or a home office, you want to consider all of the pros and cons of each space. For instance, if you need to conduct meetings with other colleagues and clients in Manhattan, consider a shared workspace like Broadway Suites. We offer staffed, secure office space with flexible leases and customizable floor plans that suit your business, and virtual Manhattan office space options for budding entrepreneurs wanting mail collection and occasional meeting space at a desirable Manhattan zip code.